The Immaculate Timing of Satoshi Nakamoto

.avif)

In this article:

Like you, we spend most of our time in complete awe of Bitcoin.

To create something with such an inspired design requires not only expert knowledge of software and encryption, but also an astonishingly deep understanding of economics, monetary history, and game theory. That’s an eclectic knowledge base.

And as if that wasn’t impressive enough, consider that there’s also a very strong possibility that Bitcoin was created by just one anonymous person. A person who then went on to completely vanish into thin air, even after creating one of the most impactful technologies of the century.

Imagine just casually creating an entire global monetary system from scratch, all by yourself, and then disappearing before anyone can figure out who you are. It doesn’t even sound plausible.

Satoshi did of course have some inspiration; it would be misleading to suggest Bitcoin came out of nowhere. As we’ve discussed in previous articles, Bitcoin isn’t the first attempt to create a digital form of money free from State control. In fact, in Bitcoin’s white paper, Satoshi even references several previous attempts.

But with Bitcoin, Satoshi was the first to solve the Byzantine General’s problem and create a decentralised digital money with no single point of failure that the State can’t easily shut down or control.

Bitcoin is remarkable whichever way you look at it. It has a mysterious anonymous creator, it solves previously unsolved computer science problems, and has had a stratospheric rise into public consciousness and popularity in just 15 years.

It's quite the story. But what’s also amazing is Satoshi’s almost miraculous timing. Not only is Bitcoin an astonishing achievement, but it also arrived precisely when the world needed it most.

That’s either dumb luck or remarkable prescience….

Unsustainable Government Debt – Bitcoin Fixes This

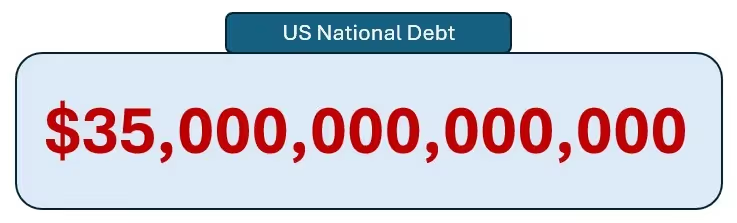

You’ve probably heard over the past couple of weeks that US Government Debt has now reached over $35 Trillion. That’s an absolutely staggering number. So staggering in fact that we thought it was worth highlighting just how many zeros that is…

But even looking at this number doesn’t really do it justice. It’s still hard to conceptualise just how enormous $35 trillion really is.

Sol et’s do some very basic arithmetic to try and get our heads around it, and get some perspective on just how careless successive US governments have been with their finances…

First, we know that $1 Trillion = (1,000 x $1 Billion)

And we know that $1 Billion = (1,000 x $1 Million)

So that means it would take you 1,000 days or 2.74 years to spend $1 Billion if you spent $1 million every single day.

And if $1 Trillion = (1,000 x $1 Billion) then at a rate of $1 million per day it would take you 1 million days or 2,737.85 years to spend $1 Trillion.

So, if you intended to spend $35 Trillion dollars, at a rate of $1 million dollars per day, it would take you 95,824.75 years to do it.

These astonishing numbers show that even if you racked up debt at a rate of $1million dollars every single day, it would take you almost 100,000 years to accrue a $35Trillion debt. You would have needed to start during earth’s Pleistocene era back when woolly mammoths roamed the earth to reach the same level of debt that the US Government holds today!

$1Trillion Interest Payments

And of course, what always accompanies debt? That’s right. Interest payments...

As you can imagine, the interest payments on a debt this large are eye-watering as well. To service this gargantuan pile of debt the US Government has already paid over $1 Trillion in interest in 2024 alone!

To put that into perspective, that’s more than the US government spends each year on things like Medicaid, Higher Education, Housing and even National Defence! That’s right, it costs more to service the US debt each year than it does to fund the military.

To put it bluntly, the US Government is practically bankrupt. If it were you or I in the same financial situation, the bailiffs would have already been round to take the house, the car and the shirts off our backs. It doesn’t take a PHD in economics to realise that this situation is anything but sustainable.

If you’re wondering why your taxes are so high while public services around you are degrading, this represents a big part of the problem.

More Inflation is Coming

But the situation couldn’t possibly get any worse right?... Right?

Well unfortunately it’s quite likely it will. In fact, it’s even likely to accelerate. The US Government is currently running a budget deficit of over $2Trillion per year. That means the national debt is going to increase to north of $40 Trillion by 2030 even at conservative estimates. In the not-too-distant future we could be living in a world where the interest payments on the debt outstrip even the government’s total tax revenues.

So, what is the US Government to do? They are clearly way past the point of ‘tightening their belts a little’ to get out of this mess and ultimately, it’s going to boil down to just two choices. Either the US government defaults on the debt, or they are forced to print more money. If history has taught us anything, it’s that when nation states find themselves in this position, they always choose the latter. Can we get one of those 0.5% rate cuts please Jerome?

And what happens to the value of a currency when you continually print more of it? Well, it loses its purchasing power, and in a worst-case scenario, it can even lead to hyperinflation. So, like anyone with unsustainable debt, the US Government finds itself in a rather sticky situation.

Prior to Bitcoin being invented, you would have found yourself trapped right there with them, forced to watch the purchasing power ofyour money get decimated to pay for their incompetence and greed with no means to escape. Fortunately, with Bitcoin you now have a way to opt out, and a place to safeguard your wealth outside of all this madness.

When you consider that Satoshi launched Bitcoin shortly after the 2008 financial crisis, and 15 years before the current mess we find ourselves in, it starts to look a lot more like prescience than simply dumb luck.

I think we can call agree that this was immaculate timing on Satoshi’s part.

Government Censorship – Bitcoin Fixes This

It’s also worth mentioning that not only did Bitcoin show up just at the right time to provide a lifeboat to the Titanic of all ponzi schemes, it also goes a long way to protect us from other forms of government tyranny and abuse as well.

As the fiat money experiment draws closer and closer to its grand finale, we have begun to see governments around the world become increasingly hostile and authoritarian toward their citizens. Armed with infinite money they have become drunk on power and have long since forgotten that they are supposed to be public servants. If they can extort you via inflation instead of direct taxation, they don’t need to care so much about keeping you sweet.

In a lot of cases, we have even seen authoritarian governments use the financial system as one of their key weapons to stamp out any opposition to their questionable schemes and demands.

During the peaceful trucker’s protest in 2022, Canadian prime minister Justin Trudeau placed financial sanctions on ordinary working people who stood up to oppose him. He closed their bank accounts, leaving them with no access to their money. He even went as far as to do the same to anyone who donated to the Trucker’s cause, despite not even attending any protests themselves.

And in the UK this year, a bemused TV audience had to listen to the former prime minister Rishi Sunak explain that he was planning on reintroducing conscription, but that he wouldn’t make it compulsory. When pressed on what he might do if nobody signed up, he suggested that he may use ‘financial sanctions’ to encourage participation. Great, so either sign up to fight in the ‘forever wars’ or be locked out of your bank account. Seems reasonable...

What’s clear is that governments are more than willing to use the financial system to force their citizens to comply with things they wouldn’t otherwise agree to. Again, we are reminded that Bitcoin’s timing is borderline miraculous. At a time when governments are increasingly willing to use the financial system to censor and control their populations, we now have away to transact with one another completely free from the risk of government censorship.

The Decline of Trust – Bitcoin Fixes This

Unfortunately, due to the decades-long malaise of the fiat monetary system, trust has been eroded across many areas of society. By nowi t’s obvious that we can’t trust our governments, and we certainly know better than to trust the banking system. But what’s worse is that the wonky incentives created by broken money means that these aren’t the only institutions and industries that now take advantage of the public’s trust.

Most of us no longer feel we can trust the food industry. Manufacturers increasingly sacrifice quality ingredients in favour of processed sludge in a race to the bottom to keep food affordable. And we see a similar degradation in quality across other industries too. House builders use increasingly cheaper materials to build homes, electronics manufacturers engage in planned obsolescence making you replace products more frequently, and you’d be hard pushed to find someone who says they believe everything they hear from the media these days.

In a world where trust is in short supply, it feels as though Satoshi must have had a crystal ball to create a monetary system that goes far beyond simply increasing trust and does away with requiring it at altogether.

The Time Has Come to Follow The Bitcoin Way

Like the friend who shows up to your BBQ with more beer just as the fridge has run dry, Satoshi’s timing was absolutely immaculate. Never has the need for uncensorable money that’s free from the ravages of debasement been more acute.

The important thing to also recognise here however is that Bitcoin requires YOU to get your timing right as well.

If you want to use Bitcoin as a tool to fully protect you from the collapse of fiat currency, then you will only achieve this goal by securing it in full self-custody. The reality is however, the opportunity to do so easily might not always be available. Governments may quickly rush to close the exits and if your Bitcoin remains on an exchange or under the purview of any 3rdparty, then you run the risk of censorship or confiscation.

Just like 2009 was the perfect time for Satoshi to launch Bitcoin. NOW is the perfect time for you to learn the skills required to take full ownership of your wealth and learn how to keep it safe. Whenever you’re ready, we’re here to help. Book a Free Consultation with us and we will make sure you’re secure with time to spare.