Can Bitcoin Stay True to Its Cypherpunk Roots?

In this article:

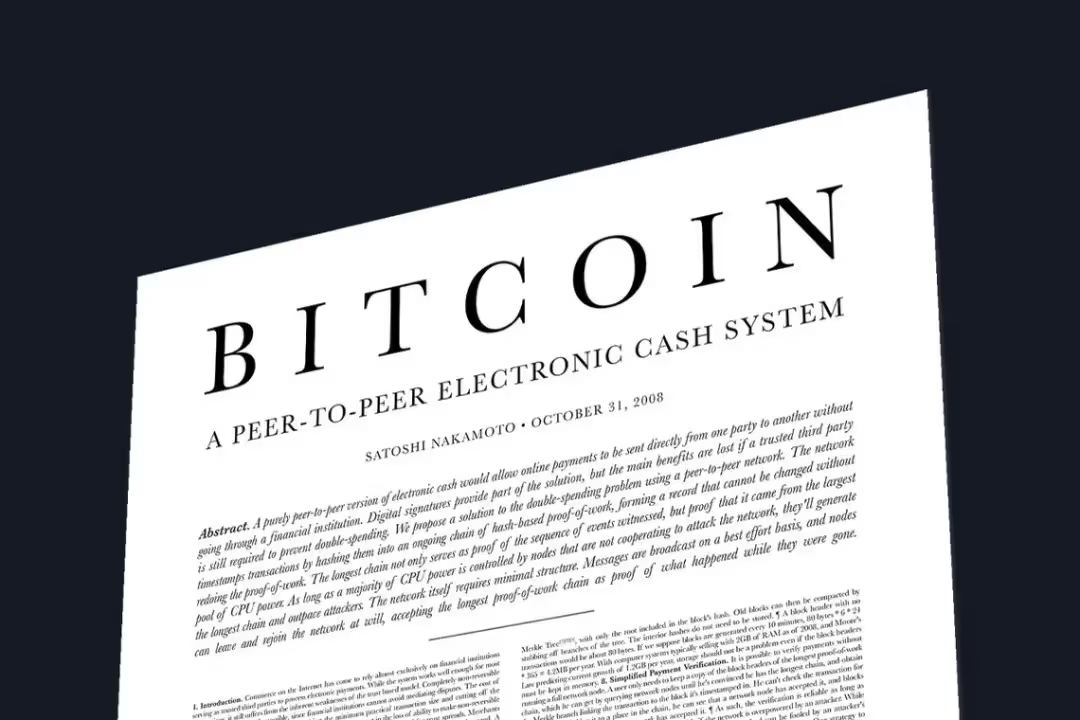

Bitcoin is undoubtedly one of the most elegant pieces of software ever written. With a whitepaper just 9 pages long, Satoshi’s design for a peer-to-peer electronic cash system has already dramatically reshaped the world in less than two decades. Once considered to be nothing more than a joke or a scam, Bitcoin now has the full attention of The Media, Wall Street, and Governments as they too capitulate into its ever-growing orbit.

Given this meteoric rise into public consciousness and the huge impact it’s already having on the world, it can become easy to lose sight of Bitcoin’s origins. Consider that for anyone born in the past 15 years Bitcoin has always been a part of their lives, and by 2040 this will include anyone aged 30 and under. As time marches inexorably forwards, it won’t be too long before nobody remembers a ‘time before Bitcoin’.

It's an exciting thought. Most of us want to see what’s possible when money and state are finally separated. We are keen to find out if Bitcoin’s promise holds true and a future of financial freedom and sovereignty awaits us and future generations. But is this future guaranteed simply because Bitcoin exists? Will Bitcoin finally be able to separate money and state even if we collectively lose sight of its origins, and of its intended purpose?

Commentators often say, ‘Bitcoin doesn’t care’. This is true, Bitcoin doesn’t care. How could it? It’s just software that keeps processing blocks of transactions every ten minutes. It doesn’t care what hopes and dreams we attach to it or the opinions we have of it.

But just because Bitcoin doesn’t care, does that mean WE shouldn’t?

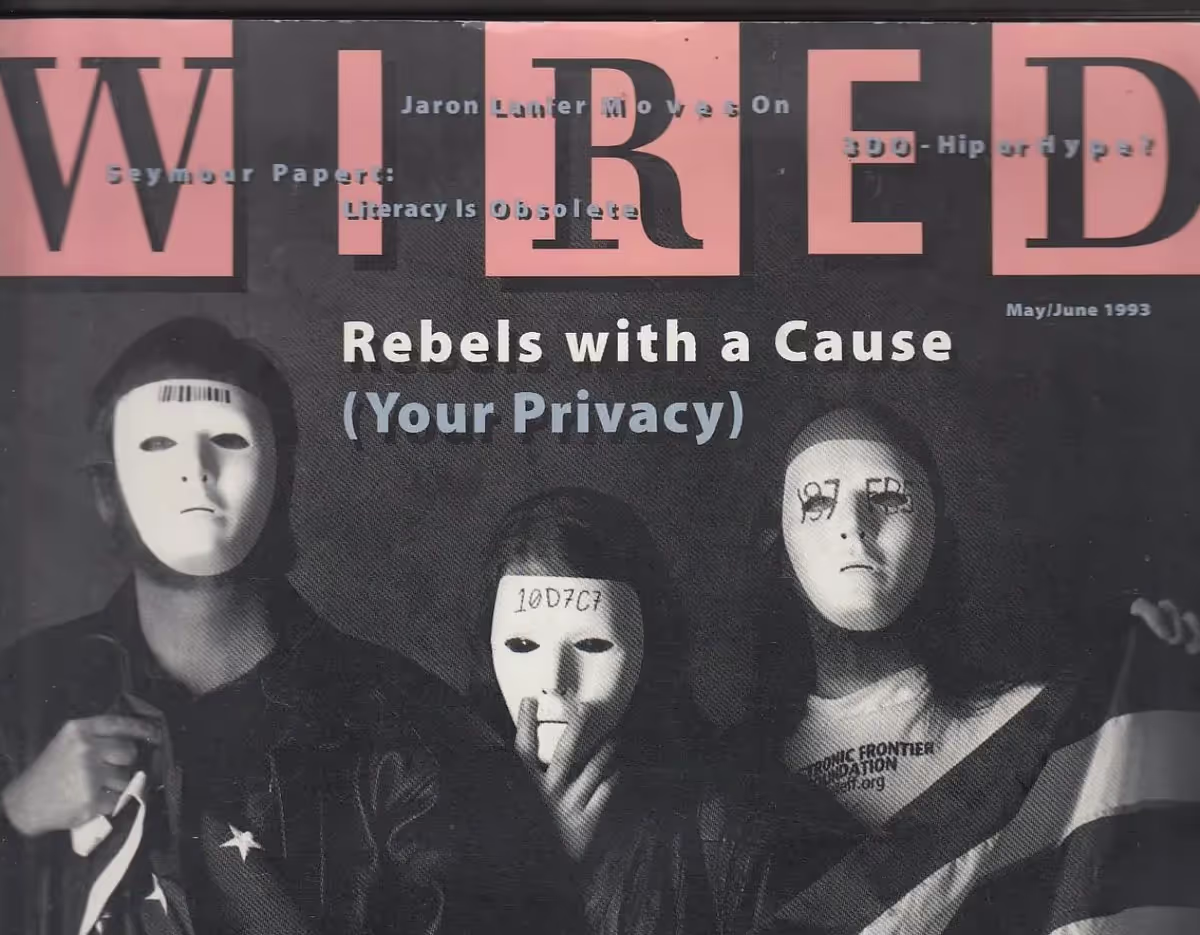

Bitcoin’s Cypherpunk Origins

Like all software, Bitcoin didn’t just emerge organically. It was designed with a specific purpose in mind. A problem to solve. Software engineers don’t just sit down and press keys haphazardly in the hope that something useful emerges. They identify problems and create solutions with clear intent. Satoshi is no different. He recognised a problem and by creating the Bitcoin software, aimed to solve it

To truly understand Bitcoin’s origins, it helps to explore the problem that Satoshi was seeking to solve. By looking at the problem from the designer’s perspective, we can better understand the proposed solution and assess how successfully these problems are addressed.

So what problem was Satoshi trying to solve?

Bitcoin emerged in 2009 in the wake of a financial crisis that shook the world’s confidence in the traditional banking sector. It is the radical response to a broken financial system plagued by rampant currency debasement and Orwellian control. A system where centralised authorities wield disproportionate power at the expense of the rest of the population. At its core, Bitcoin was conceived as a rebellion against these centralised structures that had failed people time and time again. A corrupt financial system is the problem, and Bitcoin is Satoshi’s proposed solution.

A clear indication of Satoshi’s intention is stored in Bitcoin’s genesis block itself, where he included the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This message, now inscribed upon Bitcoin’s blockchain forever, should leave us under no illusion that Bitcoin was invented in direct response to a corrupt financial system where trust in centralised institutions has been completely eroded.

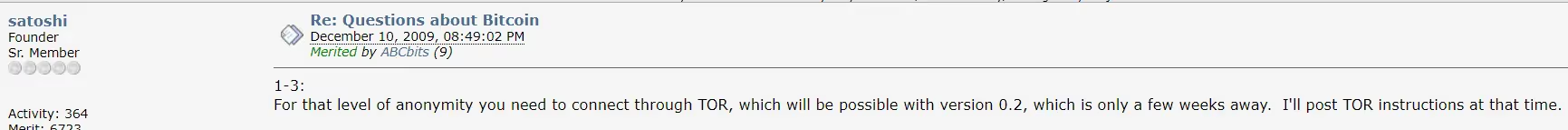

We also know that Satoshi saw value in Bitcoin users being able to maintain their privacy instead of having their entire financial lives tracked and monitored. Before his disappearance he spent time discussing Bitcoin on public forums with other users. Here in 2009, we see him discussing the best methods to ensure anonymity when using Bitcoin and actively developing Bitcoin’s software to be compatible with privacy tools.

Bitcoin’s design and the philosophy behind it closely mirror the principles of the cypherpunk movement. A movement whose goals are to use cryptography and decentralised systems to empower citizens and promote their privacy. Bitcoin was always designed to be a tool for freedom; an alternative to the corrupt centralised systems where every detail of our financial lives can be monitored and controlled. Bitcoin wasn’t designed to be just another financial asset. It represents the opportunity to have a completely alternative system altogether. One where private citizens can transfer value directly with one another completely free from interference by the banks or the state.

Mainstream Adoption – But at What Cost?

If Bitcoin is designed to be an alternative financial system, then for it to have achieved its goal it must reach some semblance of mass adoption. A financial system isn’t much use if only a handful of people use it. For Bitcoin to totally displace the dystopian world of central banking and mass financial surveillance it first needs to onboard a critical mass of users.

But should seeking mass adoption come at any cost?

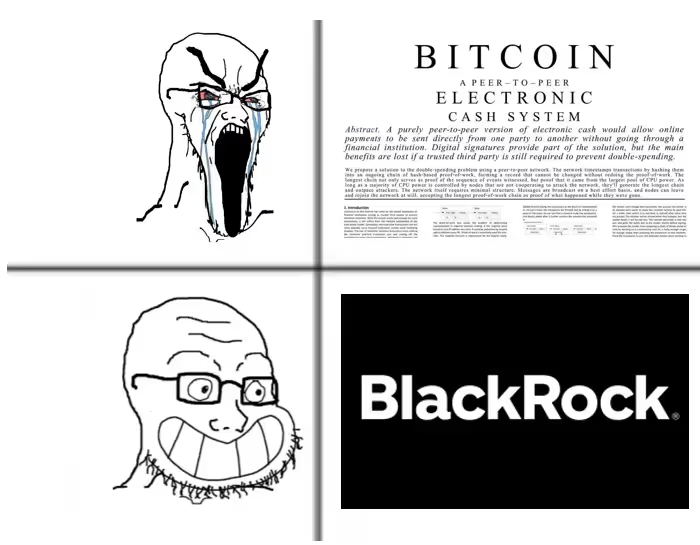

Many would argue that mass adoption is already here or at least just around the corner. To illustrate this point they would point to the fact that Wall Street now offers Bitcoin ETFs and that you can now hold Bitcoin in an IRA. “It has never been easier to invest in Bitcoin” they cheer. “Mass adoption is finally here, we’re gonna be rich!”

If this doesn’t give you pause for thought, it should.

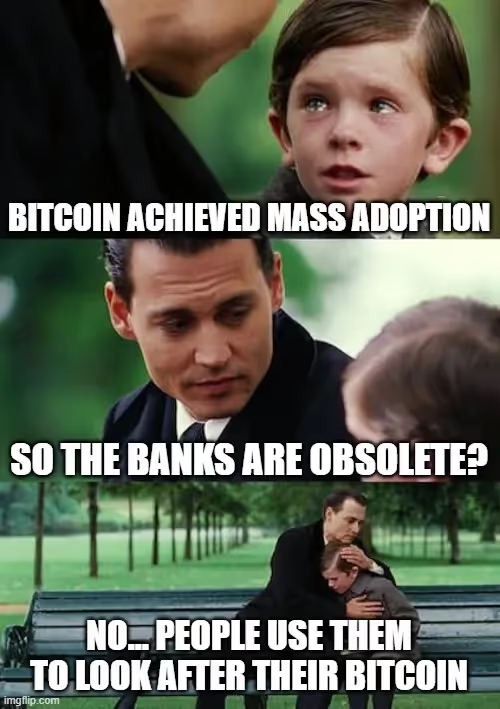

Of course, mass adoption is a key requirement on Bitcoin’s journey to successfully separate money and state. But if mass adoption is achieved by forgoing Bitcoin’s original cypherpunk ethos, can it really provide the financial freedom we so desperately need? Satoshi designed Bitcoin to be a bearer asset, a way to transact directly and privately with others without gatekeepers and without needing permission. If mass adoption is achieved through people storing their Bitcoin with third parties, then have we really achieved these goals? Have we really solved the problem Satoshi set out to originally solve?

Incumbents in the traditional financial system are very quickly adapting to a world where Bitcoin exists. Rather than accepting this as the beginning of their eventual obsolescence they are instead finding clever ways to promote Bitcoin that ensure they remain relevant. Rather than trying to hold back mass adoption they are instead helping to drive it, and they’re putting themselves in the driving seat.

The result is people adopting Bitcoin in their droves, which on the surface sounds like a good thing. The problem however is that these people aren’t adopting Bitcoin to achieve freedom and sovereignty. Instead, they have been lured into seeing Bitcoin only as a tool for speculation. They happily forgo any financial privacy and bend the knee to KYC regulations while trusting bankers to manage their wealth again. Even those using collaborative custody solutions seem to have no regard for their privacy as they happily expose their XPUBs revealing every aspect of their financial lives to 3rd parties.

If Bitcoin’s explicit purpose is to create a financial system free from control and Orwellian style surveillance, then giving up your privacy to allow a trusted third party to look after your wealth is the antithesis of what Satoshi was trying to achieve.

Playing into the Hands of Custodians

So why is this happening? Why is it that when presented with the keys to financial freedom people still decide to trust regulated third parties in exchange for self-sovereignty and privacy?

Satoshi gave us a trust-less system, but it seems that people simply don’t trust themselves to be the master of their own destiny. Becoming self-sovereign doesn’t happen just because a person owns some Bitcoin. It also requires them to get comfortable with new hardware, new software, and the new mindset of being their own bank and privately managing their own wealth. It appears that most are simply not yet ready or don’t yet feel confident enough to do it. Or perhaps they are simply led toward custodians through convenience.

This shouldn’t really come as much surprise. When weighing up their options, a lot of people will be pushed toward custodians, ironically by the bitcoin community itself. Instead of being a welcoming space that encourages people to start their learning journey on the path to financial freedom newcomers are instead confronted with mixed messages, arrogance, and confusing technical debate.

A good example of this is the ongoing battles between hardware wallet manufacturers. Instead of trying to ‘grow the pie’ by onboarding more users to the advantages of self-custody, they instead expend a huge amount of energy simply fighting one another in an attempt to position themselves as the best solution.

Whilst these academic debates may be interesting to cyber security professionals, it is confusing and off-putting to newcomers. It makes them feel out of their depth. Fearful of making a mistake is it any wonder that many conclude that self-custody just isn’t for them? This in-fighting and mudslinging results in a zero-sum game that no doubt costs potential new customers to the companies involved.

The benefits of freedom money might sound great, but they aren’t enough to overcome the fear of losing one’s entire wealth. When people aren’t sure which way to turn, they will fall back on what they know; letting a custodian take care of it. It becomes the path of least resistance.

This is an enormous, missed opportunity for the Bitcoin community and the companies involved. By shifting focus away from in-fighting and toward helping the average user get comfortable with these new skills it would successfully keep more people out of the clutches of the Panopticon currently being constructed by centralised exchanges, hedge funds and chainalysis companies. Hardware companies would sell more units and the Bitcoin ecosystem would be all the more resilient and decentralised for it.

Reclaiming Bitcoin’s Core Principles

When you reflect on all of this, the fact that so many custodians and 3rd parties exist in Bitcoin, and that most of them dutifully KYC their customers and comply with Government regulation is almost comical.

Satoshi designed a piece of software that allows us to crawl out from under the boot of financial oppression at the hands of central banks and governments. A lot of ‘Bitcoiners’ then proceeded to adopt this invention by crawling right back under the boot again. Instead of privately transacting peer to peer most treat Bitcoin as nothing more than a common stock.

And why is this happening? It’s happening because, as we are busy debating one another in our niche circles, Bitcoin’s core principles become more and more diluted over time.

Where discourse once focussed on freedom, sovereignty, and privacy it has now been replaced with a carousel of mediocre influencers babbling on about ETF inflows and outflows or recording yet another macro-economic podcast where people discuss how Bitcoin is performing compared to worthless government coupons.

How excruciatingly tedious.

It’s high time that Bitcoin’s core principles were brought back to the fore. If we want a future where centralised authoritarians have become obsolete, then we need to start by showing people they no longer need them. We can only manage this if we drop the infighting and show people that it isn’t too scary, that they are ready, and that it’s absolutely something they can achieve.

If we don’t keep beating the drum of Bitcoin’s original ethos and if we keep arguing amongst ourselves, then we shouldn’t be surprised when our message gets drowned out by Macro Economic Moonbois’ and the slick marketing of the world’s biggest hedge funds.

Bitcoin doesn’t care of course, but we should.

The Bitcoin Way – Committed to Freedom Money

Here at the Bitcoin Way, we want to reaffirm our commitment to the original cypherpunk ethos of Bitcoin. We believe that the path to a better future lies in creating a completely new financial system where custodians, gatekeepers and draconian KYC regulations become a distant memory.

We commit to continuing to teach people how to achieve their freedom and to make this accessible for anyone no matter where they are on their own learning journey.

We commit to making sure we don’t lose sight of the big picture in favour of circular debate or trying to score points amongst our peers.

We commit to making it our mission to set as many people free as we can. We hope to have you stood beside us.

If you or someone you know is ready to take that brave first step and claim their Bitcoin sovereignty, then we would love to be the ones to help. We will help you cut through all the noise and find the right setup for you. It’s easier than you think and you’re absolutely capable. It’s there for the taking and there is no better time to start than now.